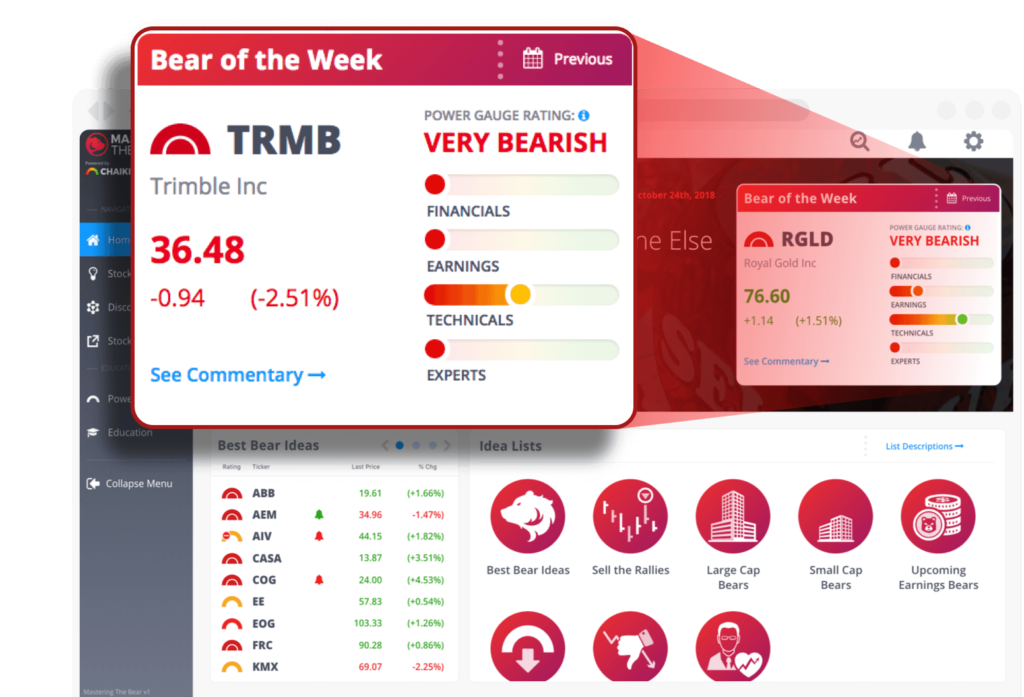

Market Survival Guide Weekly Newsletter

DESCRIPTION: Each week, with the Market Survival Guide, you will be emailed an action plan for how to SURVIVE and THRIVE in the current market conditions. When the market is going up, you will know where to look for profitable trade ideas.

When the market is tanking, you will know how to preserve wealth, avoid landmines, and also profit from shorting overvalued stocks. In addition, each newsletter is packed with bullish and bearish trade ideas with the greatest odds for success.

Not only will these investment opportunities be hand-selected by Dan Russo, CMT, he will spell out his approach to finding them so you can, too!

Additional Promotional Item Examples

DISCLOSURES:

Chaikin Analytics, LLC, and its parent Chaikin Holdings, LLC (the “Company”) are not registered as a securities broker dealer or investment advisor with either the U.S. Securities and Exchange Commission or with any state securities regulatory authority.

The Company is not responsible for trades executed by users of their reports, analytics, web sites or mobile apps based on the information included herein. The information presented in the Company’s reports, analytics, etc. does not represent a recommendation to buy or sell stocks or any financial instrument nor is it intended as an endorsement of any security or investment. The information is generic by nature and is not personalized to the specific financial situation of any individual.

The user bears complete responsibility for their own investment research and should seek the advice of a qualified investment professional before making any investment decisions. Past performance is no guarantee of future results.

Disclaimer CFTC RULE 4.41: Hypothetical or simulated performance results have certain limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not been executed, the results may have under or over compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profit or losses similar to those shown.